21 January 2025

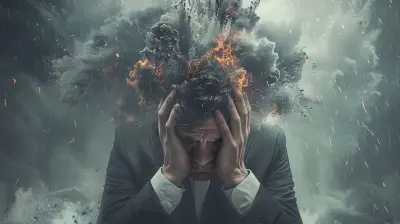

Let’s face it—managing business debt can feel like walking on a tightrope while juggling flaming torches. One wrong move, and it all comes crashing down. But here’s the good news: it doesn’t have to be that scary! With the right mindset and a solid plan, you can handle business debt like a boss.

Whether you’re a startup founder trying to stay afloat or a seasoned entrepreneur looking to expand, understanding when to pay down debt and when to borrow more is key to long-term success. So grab a coffee (or tea, no judgment here), and let’s break it all down in simple terms.

The Basics of Business Debt: A Love-Hate Relationship

Debt, my friend, is like your meddling-but-sometimes-helpful cousin. It can save you when you’re short on cash, but it can also overstay its welcome if you’re not careful. Let’s break it down:- Good Debt: Think of this as your golden ticket to growth. A business loan to buy new equipment or invest in marketing? That’s the good kind.

- Bad Debt: This is the dark cloud hanging over your business. High-interest credit cards or loans you can’t repay? Yep, that’s the kind you want to avoid like a pop quiz.

Managing debt isn’t about avoiding it altogether. It’s about making it work for you without letting it take over your life.

When It’s Time to Pay Down Your Debt

Paying down debt feels great, doesn’t it? Like finally cleaning out your inbox or finishing that Netflix series you’ve been procrastinating on. But not all debts are created equal, and knowing when to pay them off takes a little strategy.1. High-Interest Debt? Crush It First!

Imagine having a leaky faucet at home. It’s annoying, right? Now imagine that faucet is spewing money—your money. That’s what high-interest debt does. Credit cards, payday loans, or any other debt charging sky-high interest rates should be at the top of your hit list.Why? Because the longer you keep them around, the more they’ll cost you. Paying these off first frees up cash flow and saves you money in the long run.

2. Your Cash Flow Is Strong

If your business is bringing in consistent revenue and you’ve got a solid emergency fund, it might be time to tackle your debt. Having that financial cushion means you’re not putting yourself at risk by aggressively paying down balances.Pro tip: Set aside 3–6 months’ worth of operating expenses before going all-in on debt repayment. You don’t want to be caught off guard by an unexpected expense.

3. You’re Approaching the Debt Ceiling

If your debt-to-income ratio (the amount of debt you have compared to your income) is creeping toward uncomfortable levels, it’s time to pump the brakes. This isn’t just about making yourself feel better—it’s also about keeping lenders happy. Too much debt can throw up red flags and make it harder to get loans in the future.

When It’s Time to Borrow

Wait a minute. Borrow more? It sounds counterintuitive, right? Well, borrowing doesn’t always mean you’re in trouble. In fact, debt can be a powerful tool when used wisely. Think of it as fuel for your business rocket ship—just make sure you’re pointed in the right direction.1. There’s a Clear ROI

If you’re borrowing money to take advantage of a clear opportunity for growth, that’s a green light.For example:

- Expanding your product line

- Opening a new location

- Investing in technology to streamline operations

Ask yourself: Will this investment generate enough revenue to cover the cost of borrowing? If the answer is yes, go for it.

2. Interest Rates Are Low

Who doesn’t love a good bargain? When interest rates are low, it’s a great time to borrow. You’ll save money over the life of the loan and have more wiggle room in your budget.Keep an eye on economic trends and work with a financial advisor to snag the best deals. Timing is everything!

3. You’re Managing Debt Responsibly

If your existing debt is under control and you’ve got a solid repayment history, borrowing more might actually improve your creditworthiness. Crazy, right? Lenders like to see that you’re capable of handling debt responsibly.It’s like when you rent a fancy Airbnb—if you leave it spotless, the host will probably welcome you back with open arms.

How to Balance Paying Down and Borrowing

This is where the art of managing business debt comes in. You want to find a balance between paying off what you owe and borrowing strategically to grow your business.Think of it like driving a car. Paying down debt is like hitting the brakes—it slows you down but gives you control. Borrowing is like pressing the gas—it speeds things up but requires careful steering.

1. Prioritize Your Goals

Ask yourself: What’s more important right now? Reducing debt or funding growth opportunities? The answer will depend on your business’s unique situation.2. Run the Numbers

Before making any decisions, crunch the numbers. Look at your cash flow, debt-to-income ratio, and potential return on investment. If you’re not a math wizard, no worries—this is why accountants exist.3. Stay Flexible

Business isn’t black and white. Sometimes you’ll need to pivot, adjust your strategy, or take calculated risks. And that’s okay! Staying flexible helps you adapt to changing circumstances without losing sight of the big picture.Common Mistakes to Avoid

Even with the best intentions, managing business debt can get tricky. Here are a few pitfalls to watch out for:1. Overborrowing

Borrowing too much is like overloading your plate at a buffet. Sure, it looks great at first, but soon you’re overwhelmed and regretting every bite. Only borrow what you need and can realistically repay.2. Ignoring the Fine Print

Loan terms matter—big time. Always read the fine print to understand interest rates, repayment schedules, and potential penalties. You don’t want any surprises down the line.3. Neglecting Communication

If you’re struggling to make payments, don’t ghost your lender. Reach out early and often to discuss your options. Most lenders are willing to work with you if you’re upfront about your situation.Final Thoughts on Managing Business Debt

Managing business debt isn’t about being perfect; it’s about being proactive. Pay down what you can, borrow when it makes sense, and always keep your financial goals in mind.Remember, debt is a tool—it’s not the enemy. With a little strategy and a lot of determination, you can use it to build the business of your dreams.

So take a deep breath, put on your problem-solving hat, and tackle that debt like the savvy entrepreneur you are. You’ve got this!

Dixie McKeever

Great insights! Balancing debt can be tricky, but knowing when to pay down or borrow makes all the difference. Thanks for sharing these helpful tips!

February 22, 2025 at 7:48 PM